Medicare Supplements

All Medicare supplement policies (also known as Medigap) are standardized. This means they offer the same basic benefits no matter where you live or which insurance company you buy it from. In most states, companies selling Medicare Supplement insurance can only sell you a standardized policy identified by letters A through N.

Price is the only difference between plans with the same letter that are sold by different insurance companies.

Important: In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in different ways.

Every Medigap policy must follow federal and state laws designed to protect you. It’s important to watch out for illegal practices by insurance companies and protect yourself when you’re shopping for a Medigap policy.

This is why at PRESERVING PRINCIPLES we take the educational approach. We want to inform our customers of their rights and options and ensure individuals aren't overpaying on their monthly premiums.

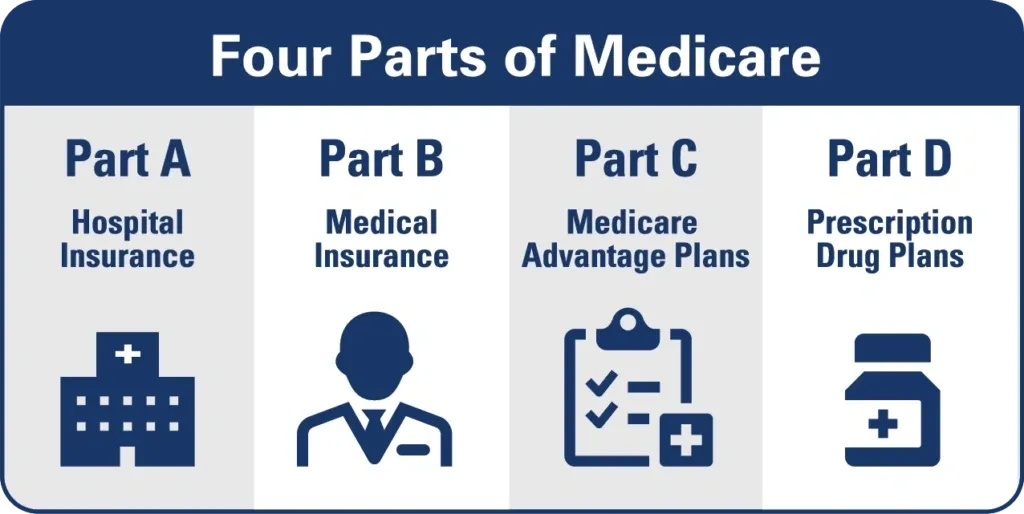

Medicare Advantage Part C

Medicare Advantage, also known as Medicare Part C, is a type of Medicare health plan offered by private insurance companies approved by Medicare. It provides all the benefits of Medicare Part A (hospital insurance) and Part B (medical insurance), and often includes prescription drug coverage as well. These plans may also offer extra benefits, such as vision, hearing, dental coverage, and fitness programs. Medicare Advantage plans usually have networks of doctors and hospitals and may require referrals to see specialists. They often have lower out-of-pocket costs and provide additional services not covered by original Medicare.

Prescription Drug Plans

The Prescription Drug Plan (PDP), also known as Medicare Part D, is a standalone plan that adds prescription drug coverage to Original Medicare (Parts A and B) or Medicare Advantage plan (Part C). These plans are offered by private insurance companies approved by Medicare. Part D helps cover the cost of prescription drugs and the specific drugs covered and costs can vary by plan. It's important to choose a plan that covers the medications you need at a cost you can afford. Part D plans typically have a monthly premium, deductible, co-payments, and coinsurance. Understanding your plan's network and using in-network or preferred pharmacies can help you save money on your prescription medications. It is important to review your plan's network before filling prescriptions to ensure you are using a pharmacy that is covered by your plan and offers the lowest cost for your medications.

Life Insurance

Life Insurance is a policy that pays out a sum of money to your beneficiaries when you pass away. This money can help replace lost income, pay off debts, cover funeral expenses, or provide financial stability for your loved ones. Life insurance can be an important financial tool to ensure your family is taken care of financially after you're gone.

Final Expense plans, also known as burial insurance or funeral insurance, are a type of life insurance policy specifically designed to cover the costs associated with funeral and other final expenses. These plans typically have lower benefit amounts than traditional life insurance policies but can provide peace of mind, knowing that your loved ones won't have to bear the financial burden of your final expenses.

The importance of life insurance and final expense plans lies in their ability to provide financial protection and peace of mind to your loved ones during a difficult time. They can help ensure that your final wishes are carried out without placing a financial strain on your family. By having these plans in place, you can help protect your family's financial future and provide them with the support they need when you're no longer there.

Cancer Plans

Cancer plans are designed to provide financial assistance and support if you are diagnosed with internal cancer or melanoma. They can help cover the costs associated with cancer treatment that may not be fully covered by your regular health insurance. These plans typically provide benefits for things like chemotherapy, radiation therapy, surgery, and other cancer-related treatments and services. The importance of a cancer insurance plan lies in the fact that cancer treatment can be extremely expensive, even with health insurance. Costs can include deductibles, co-payments, coinsurance, and expenses like transportation, lodging, and childcare during treatment. A cancer insurance plan can help alleviate some of these financial burdens, allowing you to focus on your recovery without worrying about the cost as much.

Hospital Indemnity Plans

Hospital Indemnity Plans are supplemental insurance policies that pay a fixed amount of money if you are hospitalized for a covered illness or injury. Unlike traditional health insurance plans, which pay healthcare providers for medical services, hospital indemnity plans pay you directly. You can use this money to help cover expenses such as deductibles, co-payments, and other out-of-pocket costs associated with a hospital stay.

The purpose of a hospital indemnity plan is to provide financial protection and help offset the costs of a hospital stay that may not be covered by your regular health insurance. These plans can be particularly beneficial if you have a high-deductible health plan or if you want extra coverage for hospital expenses. Hospital Indemnity plans can provide peace of mind, knowing that you have financial support in place if you need to be hospitalized.

Certain hospital indemnity plans offer additional benefits that can be added to customize coverage based on individual needs. These additional benefits or riders can include coverage for outpatient surgery, physical therapy, urgent care costs, skilled nursing costs, and ambulance costs. By adding these types of benefits to a hospital indemnity plan, individuals can customize their coverage to better meet their specific needs and budget. This can provide peace of mind knowing that they have coverage for a wide range of services that may not be fully covered by their regular health insurance.

Annuities

Annuities, particularly fixed and fixed index annuities, can play a significant role in retirement planning and asset preservation for those concerned about loss or risk:

For retirees concerned about preserving assets and avoiding market risk, these annuities can be appealing. They provide a level of security and stability, ensuring a stream of income without the fear of losing assets due to market volatility. However, it's important to carefully consider the terms, fees, and surrender charges associated with annuities, as they can vary widely and impact your overall financial plan.

Dental & Vision

Dental and vision care are important aspects of overall health and well-being, yet Original Medicare (Parts A and B) and ACA insurance do not typically cover routine dental or vision care. This can leave many people without coverage for important services like dental cleanings, eye exams, glasses, and other vision-related care. Having a separate dental and vision insurance plan can help fill this gap in coverage. These plans often provide benefits for preventive care, such as routine exams and cleanings, as well as coverage for more extensive services like fillings, extractions, and eyeglasses or contact lenses. Regular dental and vision check-ups can also help prevent more serious health issues, making these plans important for overall health maintenance.

Affordable Care Act (ACA)

The Affordable Care Act (ACA), also known as Obamacare, is a law designed to make health care more affordable and accessible for Americans. It provides a range of benefits, including protections for those with pre-existing conditions, allowing young adults to stay on their parents' insurance until age 26, and expanding Medicaid eligibility for low-income individuals and families. The ACA also established health insurance marketplaces where individuals and small businesses can compare and purchase health insurance plans. Additionally, the law includes provisions to promote preventative care and improve the quality of care provided by healthcare providers. Overall, the ACA aims to ensure that all Americans have access to quality, affordable healthcare coverage.

There are several situations where it might make sense for someone to get coverage through the ACA marketplace:

1. Lack of Employer Coverage:

If you don't have access to health insurance through your employer or if the coverage offered is unaffordable.

2. Income Level:

If your income falls within a certain range, you may qualify for subsidies or tax credits to help lower the cost of insurance purchased through the marketplace.

3. Pre-Existing Conditions:

The ACA prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions, making it a valuable option for those with health issues.

4. Young Adults/Life Changes:

Events like getting married, having a baby, or losing other health coverage can qualify you for a Special Enrollment Period (SEP) to enroll in an ACA plan outside of the annual Open Enrollment Period. Keep in mind, this SEP typically begins 60 days before and ends 60 days after certain qualifying life events. It is important to act promptly during your SEP to ensure you have continuous health insurance coverage.

5. Medicaid Expansion:

In states that have expanded Medicaid under the ACA, individuals and families with limited income may qualify for Medicaid coverage.

6. Retired, but Not Medicare Eligible (65+):

If you retire before age 65 and lose employer-sponsored coverage health insurance, you may face a gap in coverage until you become eligible for Medicare. ACA plans can provide coverage during this gap, ensuring you have access to necessary healthcare services.